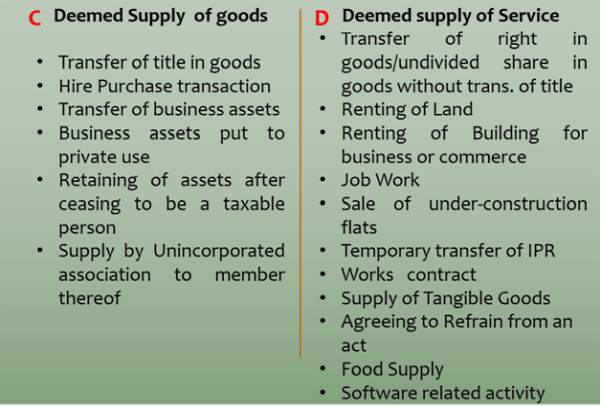

Under GST, there are various types of supply on the basis of nature. Some of the types are … | Type, Different types, Composition

Nexdigm - With #Oman #VAT implementation on the horizon, the businesses must evaluate the compliance requirements. #DidYouKnow which supplies would be considered as deemed supply of goods under Oman VAT? Read through

%20Deemed%20Supply%20of%20Capital%20Goods%20sent%20by%20Principal.png)

%20Deemed%20Supply%20by%20Principal.png)